What Does a Bookkeeper Do? And Why Every Business Needs One

If you run a business, freelance, sell online, or manage multiple income streams, you’ve probably heard the term bookkeeper. But what does a bookkeeper actually do—and why is bookkeeping so important for your business?

In simple terms, a bookkeeper is the person who keeps your financial records accurate, organized, and tax-ready. In reality, good bookkeeping does much more than just record numbers—it gives you clarity, control, and confidence in your finances.

What Is Bookkeeping?

Bookkeeping is the day-to-day process of recording, organizing, and maintaining a business’s financial transactions. This includes tracking income, expenses, payments, and balances so that your financial data is always reliable.

Unlike tax filing, which usually happens once a year, bookkeeping is ongoing. It is the foundation of your accounting system and the backbone of informed business decisions.

What Does a Bookkeeper Actually Do?

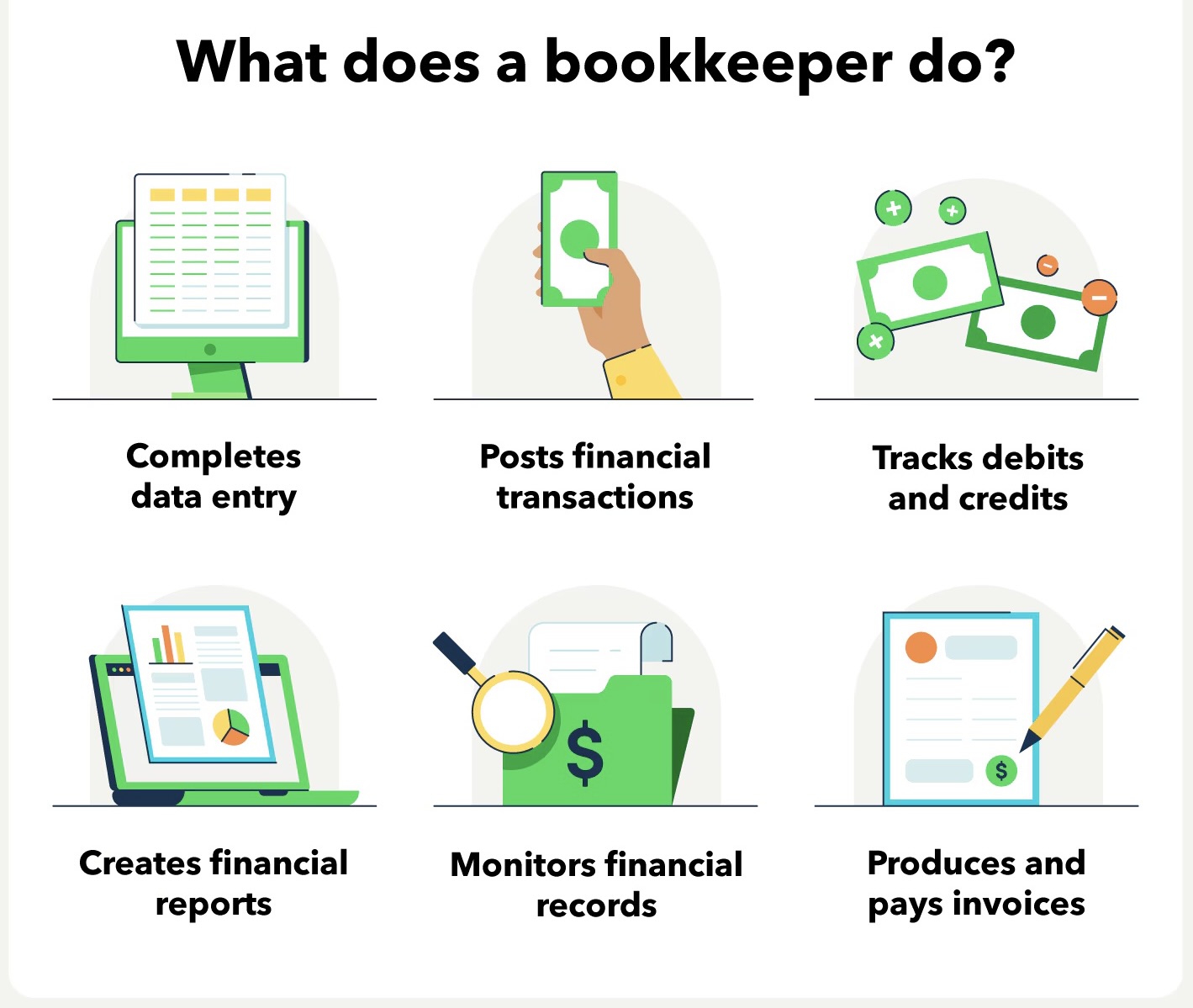

A professional bookkeeper handles much more than basic data entry. Core responsibilities typically include:

1. Recording and Categorizing Transactions

Every sale, expense, bank deposit, and payment is properly recorded and categorized in accounting software such as QuickBooks or Xero. This ensures your financial reports are accurate and meaningful.

2. Bank and Credit Card Reconciliation

A bookkeeper matches your books with your bank and credit card statements to confirm that balances are correct and no transactions are missing or duplicated.

3. Managing Income and Expenses

Bookkeeping helps you understand where your money is coming from and where it is going, which is essential for cash flow management and profitability.

4. Preparing Financial Reports

Bookkeepers generate key reports such as:

-

Profit & Loss Statement

-

Balance Sheet

-

Cash Flow Report

These reports help you evaluate business performance and make informed decisions.

5. Keeping Your Books Tax-Ready

Accurate bookkeeping ensures that when tax time arrives, your records are clean, organized, and compliant—saving time, stress, and potential penalties.

6. Supporting Payroll and Contractor Payments

Many bookkeepers assist with payroll tracking, contractor payments, pay stubs, and 1099 reporting to ensure compliance with labor and tax regulations.

Bookkeeper vs Accountant: What’s the Difference?

A bookkeeper focuses on daily financial accuracy and organization, while an accountant typically handles tax filing, compliance, and high-level financial analysis.

Think of bookkeeping as the groundwork. Without clean books, even the best accountant cannot deliver accurate tax returns or financial advice.

Why Hiring a Bookkeeper Is a Smart Business Decision

Many business owners try to manage their own books, especially in the early stages. However, poor or inconsistent bookkeeping often leads to:

-

Incorrect financial reports

-

Missed deductions

-

Cash flow surprises

-

Stress during tax season

A professional bookkeeper helps you:

-

Save time and focus on growing your business

-

Avoid costly mistakes

-

Stay compliant with tax laws

-

Gain real visibility into your finances

Who Needs Bookkeeping Services?

Bookkeeping is essential for:

-

Small and medium-sized businesses

-

E-commerce sellers (Amazon, Shopify, Etsy)

-

Freelancers and consultants

-

Agencies and service providers

-

Real estate and rental property owners

-

Startups and growing companies

If money flows in and out of your business, you need bookkeeping.

Modern Bookkeeping Is 100% Cloud-Based

Today’s bookkeeping services are cloud-based, meaning your books are managed securely online. You can access your financial data anytime, from anywhere, and review reports through regular video meetings—no physical paperwork required.

This makes professional bookkeeping more affordable, transparent, and scalable than ever before.

Final Thoughts

A bookkeeper is not just someone who records numbers. A good bookkeeper is a financial partner who helps keep your business organized, compliant, and financially healthy.

If your books are behind, messy, or causing stress, it may be time to work with a professional bookkeeping service that ensures accuracy, clarity, and peace of mind—month after month.